Imaging technologies have revolutionized insurance claims evaluation, offering you five key benefits. First, aerial damage assessment using drones and satellites provides a thorough view of large-scale disasters. Second, rapid claims processing leverages AI to analyze images, considerably reducing turnaround times. Third, fraud detection improves with high-resolution imagery that can spot inconsistencies and pre-existing damage. Fourth, precise measurement and documentation through 3D modeling guarantee accurate damage assessments. Finally, risk assessment and mitigation are enhanced by identifying potential hazards and vulnerabilities. These advancements not only streamline the claims process but also improve accuracy and customer satisfaction. Discover how these innovations are transforming the insurance industry.

Aerial Damage Assessment

Countless insurance companies now rely on aerial damage assessment to streamline their claims evaluation process. This cutting-edge technique allows adjusters to quickly survey large areas affected by natural disasters or widespread damage events.

By using drones, satellites, or aircraft equipped with high-resolution cameras, you can capture detailed images of affected properties without setting foot on the ground. Aerial imaging provides you with a bird's-eye view of the damage, helping you assess the extent of destruction across multiple properties simultaneously.

You'll be able to identify patterns of damage, prioritize high-risk areas, and allocate resources more efficiently. This technology also enhances safety by reducing the need for adjusters to enter potentially hazardous environments.

With aerial imagery, you can create detailed maps and 3D models of damaged areas, allowing for more accurate measurements and estimates. You'll save time and money by reducing on-site visits and expediting the claims process.

Additionally, these images serve as valuable documentation for future reference and can help detect potential insurance fraud by comparing pre- and post-event conditions.

Rapid Claims Processing

Building on the efficiency gained through aerial damage assessment, rapid claims processing has become a game-changer in the insurance industry. With advanced imaging technologies, you can now expedite the entire claims evaluation process. By leveraging high-resolution images and AI-powered analysis, you're able to quickly assess damage and make informed decisions.

You'll find that this approach considerably reduces the time between claim filing and settlement. Instead of waiting days or weeks for an on-site inspection, you can often process claims within hours. This speed not only improves customer satisfaction but also reduces your operational costs.

The imaging data allows you to create detailed digital records of each claim, making it easier to detect patterns and potential fraud. You'll also benefit from improved accuracy in damage estimation, as AI algorithms can consistently analyze images based on predefined criteria.

Moreover, you can integrate this rapid processing with your existing systems, streamlining your workflow. By automating routine tasks, you free up your adjusters to focus on complex cases that require human expertise.

This combination of speed, accuracy, and efficiency ultimately leads to better outcomes for both you and your policyholders.

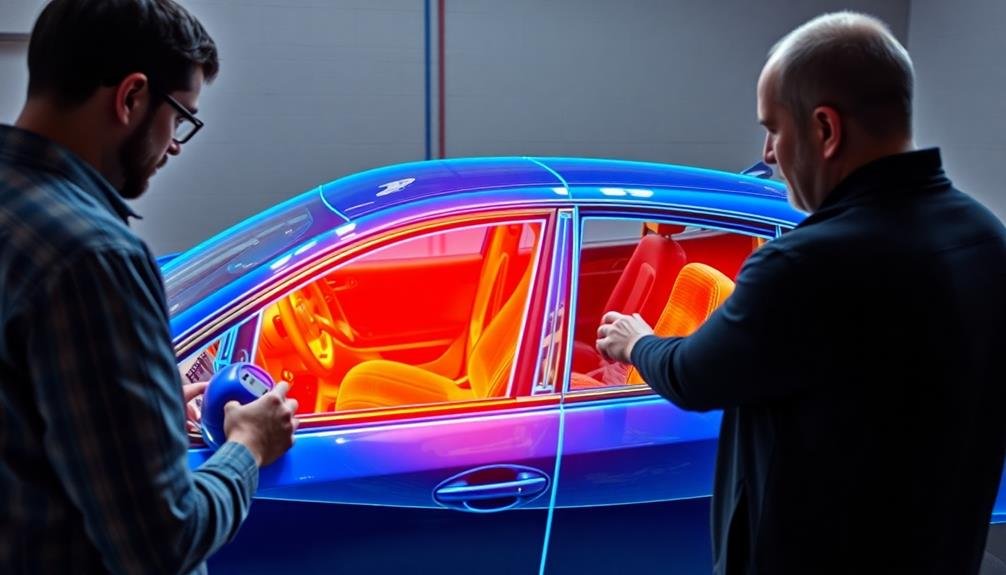

Fraud Detection and Prevention

A crucial aspect of imaging in insurance claims evaluation is its role in fraud detection and prevention. With advanced imaging technologies, you can spot inconsistencies and discrepancies that might otherwise go unnoticed. High-resolution photos and videos allow you to scrutinize damage claims more closely, helping you identify potential fraud attempts.

You'll find that imaging tools enable you to compare before-and-after pictures of property or vehicles, revealing any pre-existing damage that claimants might try to include in their current claim. Additionally, you can use satellite imagery and geolocation data to verify the location and timing of reported incidents, ensuring they align with the policyholder's statements.

Machine learning algorithms can analyze extensive amounts of image data, flagging suspicious patterns or anomalies for further investigation. This automated screening process helps you focus your efforts on high-risk claims, improving overall efficiency.

You can also use imaging to create a thorough digital record of each claim, making it easier to track repeat offenders and identify organized fraud rings. By leveraging these imaging capabilities, you'll greatly enhance your ability to detect and prevent insurance fraud.

Precise Measurement and Documentation

Precision is the cornerstone of effective insurance claims evaluation, and imaging technology plays an essential role in achieving it.

With advanced imaging tools, you'll be able to capture detailed measurements and document damages with unparalleled accuracy. These technologies allow you to create 3D models of accident scenes, property damage, or injuries, providing a thorough view that traditional methods can't match.

You'll find that laser scanners and photogrammetry software can measure distances, angles, and volumes with millimeter-level precision. This accuracy is vital when evaluating structural damage or calculating repair costs.

High-resolution cameras and drones enable you to document hard-to-reach areas, ensuring nothing is overlooked in your evaluation.

Risk Assessment and Mitigation

Imaging technology not only enhances measurement accuracy but also revolutionizes risk assessment and mitigation strategies. You'll find that advanced imaging tools allow you to identify potential hazards and vulnerabilities more effectively.

By using drones, satellite imagery, or 3D scanning, you can assess hard-to-reach areas and create thorough risk profiles for properties and assets. These imaging techniques enable you to detect structural weaknesses, environmental threats, and safety concerns that might otherwise go unnoticed.

You can use thermal imaging to identify energy inefficiencies or potential fire hazards, while LiDAR technology helps you map flood-prone areas with precision. By leveraging these tools, you'll develop more accurate risk models and pricing strategies.

Moreover, you can use imaging data to create virtual simulations of various disaster scenarios, allowing you to test and refine your mitigation plans. This proactive approach helps you recommend targeted improvements to policyholders, reducing the likelihood and severity of future claims.

Frequently Asked Questions

How Does Imaging Technology Integrate With Existing Insurance Company Software Systems?

You'll find imaging tech seamlessly integrates with your existing insurance software through APIs and custom plugins. It'll enhance your claims processing, allowing for automatic data extraction, real-time analysis, and improved workflow efficiency across your systems.

What Training Do Claims Adjusters Need to Effectively Use Imaging Technologies?

You'll need training on imaging software, data interpretation, and digital evidence handling. You should learn about camera technologies, image analysis techniques, and how to integrate visual data into your claims assessment process. Ongoing tech updates are essential.

Are There Privacy Concerns When Using Drones for Property Damage Assessment?

Yes, there are privacy concerns when using drones for property damage assessment. You'll need to contemplate potential intrusions on neighboring properties, obtain proper consent, and follow local regulations to protect homeowners' privacy during inspections.

How Does Weather Affect the Accuracy of Aerial Imaging for Claims Evaluation?

Weather greatly impacts aerial imaging accuracy for claims evaluation. You'll find rain, snow, and fog can obscure details. Strong winds may destabilize drones. Bright sunlight can cause glare. Cloudy days often provide the best conditions.

What Are the Costs Associated With Implementing Imaging Technologies for Insurance Companies?

You'll face initial costs for equipment, software, and training. There's also ongoing expenses for data storage, maintenance, and upgrades. However, you'll likely see long-term savings through improved accuracy and faster claims processing.

In Summary

You've seen how imaging revolutionizes insurance claims evaluation. From aerial assessments to fraud prevention, these technologies streamline processes and improve accuracy. They'll help you process claims faster, measure damage precisely, and detect potential fraud. You'll also be better equipped to assess and mitigate risks. As imaging tech continues to advance, you can expect even more innovative solutions to enhance your claims evaluation processes. Embrace these tools to stay competitive and efficient in the insurance industry.

As educators and advocates for responsible drone use, we’re committed to sharing our knowledge and expertise with aspiring aerial photographers.

Leave a Reply