To assess crop insurance claims with UAV technology, you'll need to leverage drones equipped with multispectral cameras for aerial surveys. Start by planning your flight path and ensuring compliance with local regulations. Capture high-resolution imagery of the affected fields, then process and analyze the data using specialized software. Look for signs of crop stress, damage patterns, and overall health indicators. Compare aerial findings with ground-truth observations and policyholder reports. Integrate the UAV data into your claims documentation for more accurate and efficient assessments. This approach speeds up processing, reduces costs, and enhances the precision of your evaluations. The future of crop insurance lies in these advanced technological solutions.

Understanding UAV Technology in Agriculture

Numerous farmers and agricultural professionals are embracing UAV technology to revolutionize their operations. UAVs, or unmanned aerial vehicles, are remote-controlled aircraft equipped with sensors and cameras. They're capable of capturing high-resolution imagery and data from above your fields.

In agriculture, UAVs offer a bird's-eye view of your crops, allowing you to spot issues that aren't visible from the ground. You'll be able to detect plant stress, pest infestations, and irrigation problems early on.

These drones can be fitted with various sensors, including multispectral and thermal cameras, to provide detailed information about crop health, soil moisture, and nutrient levels.

You'll find that UAVs are particularly useful for large-scale farming operations, as they can cover vast areas quickly and efficiently. They're also valuable for monitoring hard-to-reach or hazardous areas of your fields.

With the data collected by UAVs, you can make informed decisions about crop management, resource allocation, and yield predictions. This technology is rapidly becoming an essential tool for precision agriculture, helping you optimize your farming practices and increase productivity.

Benefits of Drone-Assisted Claim Assessment

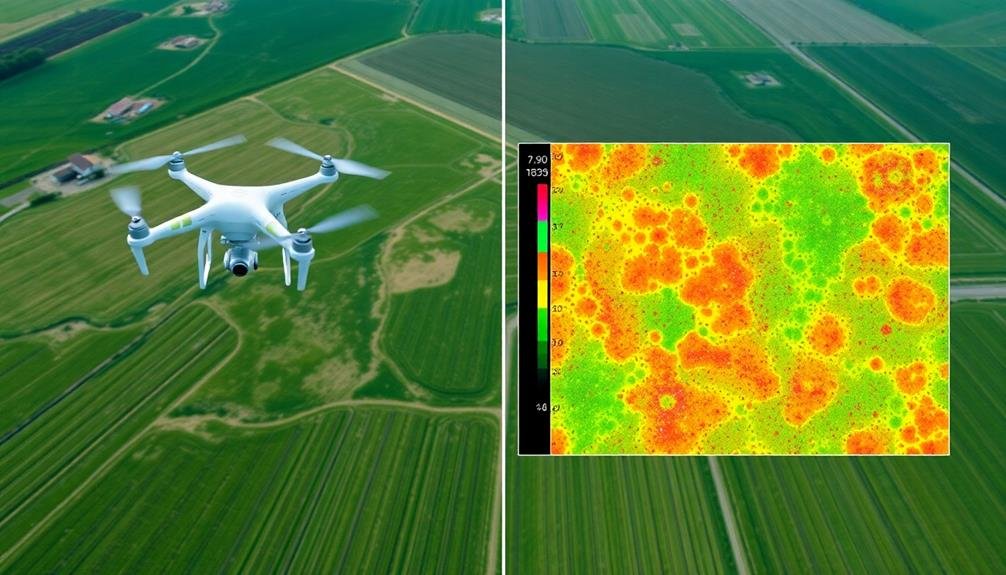

UAV technology isn't just revolutionizing day-to-day farming operations; it's also transforming the crop insurance claim process. When you're facing crop damage, drones can help you assess the situation quickly and accurately. They provide a bird's-eye view of your fields, capturing high-resolution images and data that traditional ground surveys can't match.

Here are four key benefits of using drones for crop insurance claims:

- Speed: Drones can survey large areas in a fraction of the time it takes for manual inspections, allowing for quicker claim processing.

- Accuracy: High-resolution imagery and advanced sensors provide precise data on crop health and damage extent, reducing disputes.

- Cost-effectiveness: You'll save on labor costs and reduce the need for multiple field visits, making the assessment process more efficient.

- Extensive documentation: Drones capture detailed visual evidence, creating a thorough record for your claim that's difficult to dispute.

Preparing for Aerial Crop Surveys

Before you plunge into aerial crop surveys, it's crucial to prepare thoroughly. Start by familiarizing yourself with local regulations and obtaining necessary permits for drone operations. Verify your UAV equipment is in top condition, with fully charged batteries and updated software.

Next, plan your flight path carefully. Use satellite imagery to identify areas of concern and create a flight plan that covers the entire affected area. Consider factors like field boundaries, obstacles, and weather conditions when mapping your route.

Calibrate your drone's sensors and cameras to guarantee accurate data collection. Choose the right time of day for your survey, typically when the sun is at its highest to minimize shadows. Select appropriate imaging equipment, such as multispectral or thermal cameras, based on the type of damage you're evaluating.

Prepare a pre-flight checklist to cover all safety measures and equipment checks. Brief your ground crew on their roles and establish clear communication protocols.

Selecting the Right UAV Equipment

When it comes to selecting the right UAV equipment for crop insurance claims, you'll need to evaluate several key factors. Take into account the specific requirements of your crop assessment tasks and the terrain you'll be surveying. You'll want a UAV that's reliable, easy to operate, and capable of capturing high-quality imagery.

To choose the most suitable UAV for your needs, focus on these key aspects:

- Flight time and range: Verify the UAV has sufficient battery life and range to cover large agricultural areas without frequent landings or battery changes.

- Camera quality: Opt for a high-resolution camera with multispectral imaging capabilities to capture detailed crop health data and identify problem areas accurately.

- Weather resistance: Select a UAV that can operate in various weather conditions, including light rain and moderate winds, to minimize survey disruptions.

- Software compatibility: Choose a UAV that integrates seamlessly with your preferred data processing and analysis software to streamline your workflow.

Don't forget to take into account the UAV's payload capacity, as you may need to attach additional sensors or equipment for specialized assessments.

Flight Planning for Insurance Inspections

With your UAV equipment selected, it's time to focus on flight planning for insurance inspections. Start by obtaining detailed information about the insured field, including its size, shape, and any potential obstacles. Use this data to create an extensive flight plan that guarantees complete coverage of the affected area.

Consider the ideal flight altitude and speed to capture high-quality imagery while maximizing efficiency. Generally, flying at 200-400 feet above ground level provides a good balance between resolution and coverage. Set your UAV's speed to around 10-15 mph for stable image capture.

Plan your flight path using a grid or lawn-mower pattern to guarantee systematic coverage. Incorporate sufficient overlap between images (70-80% front overlap and 60-70% side overlap) to facilitate accurate stitching during post-processing.

Take into account weather conditions, particularly wind speed and direction, when scheduling your flight. Avoid flying in winds exceeding 15 mph or during precipitation.

Schedule your flight during ideal lighting conditions, typically within two hours of solar noon, to minimize shadows and guarantee consistent image quality.

Data Collection Techniques and Strategies

Employing effective data collection techniques is essential for accurate crop insurance evaluations. When using UAV technology, you'll need to focus on gathering high-quality data that provides a thorough view of the crop damage. To achieve this, follow these key strategies:

- Use multispectral sensors to capture both visible and near-infrared imagery. This allows you to analyze plant health and stress levels, providing critical information for evaluating crop damage.

- Maintain consistent flight altitudes and overlap between images to guarantee uniform data quality across the entire field. This will help you create accurate orthomosaic maps and 3D models.

- Collect ground control points (GCPs) using GPS equipment to improve the accuracy of your aerial data. Place GCPs strategically throughout the field and mark them clearly for easy identification in your imagery.

- Time your flights to coincide with ideal lighting conditions, typically during mid-morning or mid-afternoon. Avoid flying during high noon to prevent harsh shadows that can interfere with image quality.

Image Processing and Analysis Methods

You'll employ multispectral image analysis to extract valuable information from UAV-captured crop data.

Machine learning algorithms can then process this data to identify patterns and anomalies in crop health.

You can calculate vegetation indices, such as NDVI, to quantify crop vigor and stress levels, providing essential insights for insurance claim assessments.

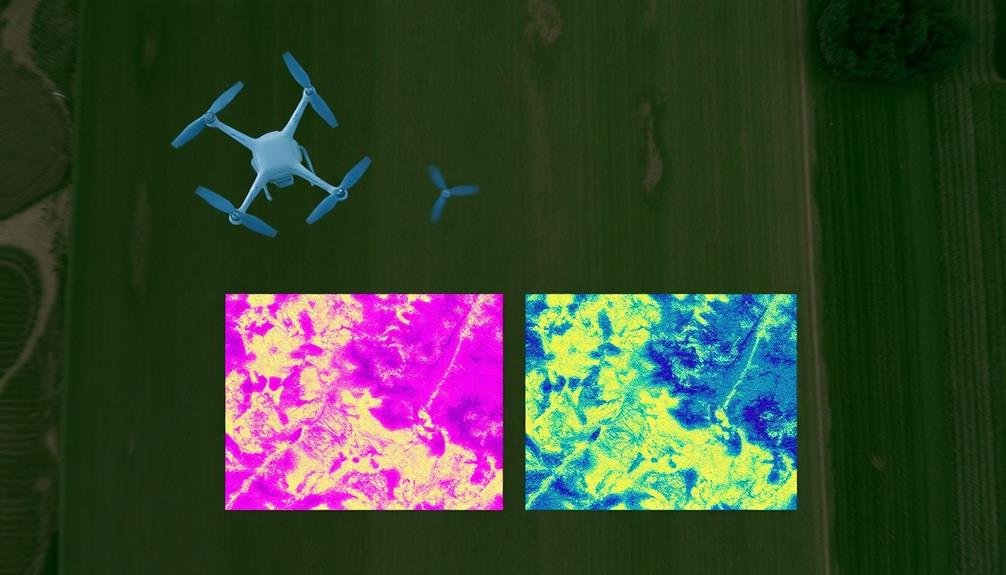

Multispectral Image Analysis

At the heart of UAV-based crop assessment lies multispectral image analysis. This technique allows you to capture and analyze data across multiple spectral bands, providing invaluable insights into crop health and damage.

By using specialized sensors, you'll collect information beyond what's visible to the naked eye, including near-infrared (NIR) and red-edge bands.

To effectively use multispectral image analysis in crop insurance claims, follow these steps:

- Calibrate your sensors before each flight to guarantee accurate data collection.

- Capture images at the ideal altitude and overlap for your specific crop and field conditions.

- Process the raw data using specialized software to create orthomosaics and vegetation indices.

- Interpret the results using established thresholds and compare them to historical data or control plots.

Machine Learning Algorithms

Machine learning algorithms take multispectral image analysis to the next level, enhancing the accuracy and efficiency of crop damage assessment. These algorithms can process vast amounts of data from UAV-captured images, identifying patterns and anomalies that might be missed by human analysts.

You'll find that supervised learning algorithms, such as support vector machines (SVMs) and random forests, are particularly useful for crop damage classification. They can be trained on labeled data sets to recognize specific types of damage, like drought stress, pest infestations, or flood impacts.

Unsupervised learning algorithms, like k-means clustering, can help you discover hidden patterns in the data, potentially revealing new insights about crop health and damage distribution.

Deep learning techniques, especially convolutional neural networks (CNNs), excel at image recognition tasks. They can automatically extract relevant features from multispectral images, making them ideal for detecting subtle signs of crop stress or damage.

You can use transfer learning to adapt pre-trained models to your specific crop insurance assessment needs, saving time and computational resources.

Vegetation Index Calculation

In addition to machine learning algorithms, vegetation index calculation forms an essential component of image processing and analysis methods for crop insurance claim assessment.

You'll use these indices to quantify plant health and vigor, providing vital data for evaluating crop damage and potential yield loss.

To effectively calculate vegetation indices from UAV imagery, follow these steps:

- Capture multispectral images: Confirm your UAV is equipped with sensors that can capture data in various spectral bands, including near-infrared (NIR) and red.

- Pre-process the imagery: Correct for atmospheric effects and georeferenced the images to guarantee accurate analysis.

- Apply vegetation index formulas: Use specialized software to calculate indices such as NDVI (Normalized Difference Vegetation Index) or GNDVI (Green Normalized Difference Vegetation Index).

- Interpret the results: Analyze the calculated index values to assess crop health and identify areas of potential damage or stress.

Interpreting Aerial Crop Damage Data

Poring over aerial crop damage data can be intimidating, but it's essential for accurate insurance claim assessments. To interpret this data effectively, you'll need to focus on key indicators of crop health and damage patterns.

First, examine the color variations in your imagery. Healthy crops typically appear as vibrant greens, while damaged areas may show up as yellow, brown, or even bare soil. Look for patterns in these color changes, as they can indicate different types of damage, such as pest infestations, drought stress, or flooding.

Next, analyze the texture and uniformity of the crop canopy. Healthy fields should have a consistent texture, while damaged areas might appear patchy or uneven. Pay attention to linear patterns, which could suggest equipment malfunction or chemical misapplication.

Compare your aerial data with ground-truth observations to validate your findings. This helps guarantee that what you're seeing from above accurately represents the situation on the ground.

Integrating UAV Data With Claims

Once you've interpreted the aerial crop damage data, it's time to incorporate this valuable information into the claims process. UAV technology has revolutionized how insurers assess crop damage, providing accurate and timely data.

To effectively integrate UAV data with claims, follow these steps:

- Cross-reference UAV data with policyholder reports

- Identify discrepancies between aerial imagery and ground-level observations

- Use UAV data to validate or challenge claim submissions

- Incorporate aerial imagery as supporting evidence in claim documentation

By combining UAV data with traditional assessment methods, you'll create a more thorough and accurate picture of crop damage.

This integration allows for faster claim processing and reduces the risk of fraudulent claims. You'll be able to make more informed decisions about claim payouts, potentially saving your company money while ensuring fair compensation for legitimate losses.

Remember to maintain clear communication with policyholders throughout the process. Explain how UAV technology is being used to assess their claim and address any concerns they may have about privacy or data accuracy.

Legal and Regulatory Considerations

As you integrate UAV technology into your crop insurance assessment process, how can you ascertain compliance with legal and regulatory requirements? First, familiarize yourself with federal and state laws governing UAV use in agriculture. Register your UAV with the FAA and obtain necessary certifications for commercial operations. Ascertain your pilots are properly trained and licensed.

Adhere to privacy regulations by obtaining consent from farmers before surveying their land. Implement data security measures to protect sensitive information collected during assessments. Stay updated on evolving regulations and adjust your practices accordingly.

Consider these key legal and regulatory aspects:

| Requirement | Action |

|---|---|

| FAA Registration | Register UAV and obtain unique ID |

| Pilot Certification | Obtain Part 107 license for commercial operations |

| Privacy Compliance | Secure written consent from landowners |

| Data Protection | Implement encryption and secure storage |

Future of Drone-Based Insurance Assessment

You'll see a shift towards automated damage detection in the future of drone-based insurance assessment.

Machine learning algorithms will analyze drone-captured imagery to identify and quantify crop damage with increasing accuracy.

This advancement will enable real-time claim processing, allowing insurers to respond more quickly to farmers' needs and streamline the entire assessment process.

Automated Damage Detection

Increasingly, automated damage detection represents the next frontier in drone-based crop insurance assessment. You'll find that advanced AI algorithms can analyze drone-captured imagery to identify and quantify crop damage with unprecedented accuracy. This technology streamlines the claims process, reducing the need for manual inspections and minimizing human error.

To implement automated damage detection in your crop insurance assessments, you'll need to:

- Invest in high-resolution drone cameras capable of capturing multispectral imagery

- Utilize machine learning algorithms trained on extensive datasets of crop damage

- Integrate automated detection software with your existing claims management system

- Regularly update and refine your AI models to improve accuracy and adapt to new damage types

You'll discover that automated damage detection can notably enhance your assessment capabilities. It allows you to quickly identify affected areas, estimate damage severity, and generate detailed reports.

This technology enables you to process claims faster, reduce operational costs, and provide more accurate payouts to policyholders. As you adopt these advanced tools, you'll position your insurance company at the forefront of innovation in the agricultural sector.

Real-Time Claim Processing

Looking ahead, real-time claim processing represents the next evolution in drone-based insurance assessment. You'll see UAVs equipped with advanced sensors and AI capabilities that can instantly analyze crop damage and transmit data to insurers. This technology will enable adjusters to make decisions on-site, dramatically reducing claim processing times.

You'll benefit from faster payouts as drones collect and process data in real-time. The system will automatically cross-reference historical data, weather patterns, and current market conditions to determine fair compensation. You'll receive instant notifications on your mobile device about claim status and expected payout amounts.

Insurance companies will integrate drone data with blockchain technology for transparent and secure claim processing. Smart contracts will automate payouts based on predefined conditions, eliminating the need for manual intervention in straightforward cases. You'll experience a streamlined process where complex claims are flagged for human review, while routine assessments are handled entirely by AI.

As this technology matures, you'll see a shift towards predictive modeling. Drones will monitor your crops throughout the growing season, alerting you to potential issues before they become serious enough to warrant a claim.

Frequently Asked Questions

How Long Does It Take to Train Insurance Adjusters in UAV Operations?

Training insurance adjusters in UAV operations typically takes 2-4 weeks. You'll learn flight basics, regulations, and data analysis. The duration can vary based on your prior experience and the complexity of the insurance applications you'll handle.

What Are the Average Cost Savings for Insurers Using Drone Assessments?

You'll find insurers can save 40-60% on average using drone assessments. They'll cut travel costs, reduce inspection time, and improve accuracy. You'll see faster claim processing and increased customer satisfaction with this technology.

Can UAVS Detect Specific Crop Diseases or Only General Damage Patterns?

UAVs can detect both specific crop diseases and general damage patterns. You'll find they use advanced sensors and imaging technology to identify distinct disease symptoms, pest infestations, and stress indicators in crops with high accuracy and detail.

How Do Weather Conditions Affect the Accuracy of Drone-Based Crop Assessments?

Weather conditions greatly impact your drone-based crop assessments. You'll find that wind, rain, and extreme temperatures can affect flight stability, image quality, and sensor readings. It's best to conduct surveys in calm, clear conditions for ideal accuracy.

Are There Any Crop Types That Are Particularly Challenging for UAV Assessments?

You'll find that tall, dense crops like corn and sugarcane can be challenging for UAV assessments. They obstruct ground visibility. Also, crops with complex canopies or those grown in terraced fields pose difficulties for accurate aerial analysis.

In Summary

You've seen how UAV technology can revolutionize crop insurance claims assessment. By embracing drones, you'll streamline the process, gather more accurate data, and make faster decisions. Remember to stay updated on regulations, invest in the right equipment, and hone your skills in flight planning and data interpretation. As this technology evolves, you'll be well-positioned to provide better service to farmers and optimize your insurance operations.

As educators and advocates for responsible drone use, we’re committed to sharing our knowledge and expertise with aspiring aerial photographers.

Leave a Reply